Ukuba ufumene ityala lerhafu ongenakukufikelela, awuwedwa. Ngoku ka Idatha ye-IRS ukusukela ngo-2019, amaMelika anetyala elingaphezulu kwe- $ 125 yezigidigidi kwirhafu engahlawulwanga, inzala, kunye nezohlwayo phakathi kuka-2018 no-2019. Nokuba utsiba iintlawulo okanye awubambanga ngokwaneleyo, imeko yakho ingangcono kunokuba ucinga.

Sukuba noxinzelelo kuba unokhetho, utshilo uNayo Carter-Grey, EA, umseki we Inyathelo lokuqala lweAccounting eBaltimore, eMaryland. Kodwa kufuneka ufake ifayile yakho yerhafu kuqala. Nje ukuba ufake ifayile, kukho ukhetho ukubuyela endleleni.

Kodwa nantoni na oyenzayo, sukutsiba umhla obekiweyo werhafu .

Nangona kunokuba kulinga ukweqa ukugcwalisa ukubuya kwakho, iingcali zithi le yimpazamo enkulu. Ukuba ucinga ukuba unetyala kwaye uza kuba nebhili enkulu, fayilisha ukubuyiswa kwerhafu ngexesha, uCarter-Grey ucebisa. Kukho isohlwayo onokuthi usiphephe xa ufaka ifayile ngomhla obekiweyo.

I-IRS ibiza isohlwayo sokungaphumeleli kwifayile yembuyekezo efakwe emva komhla wokugqibela werhafu okanye ulwandiso. Umrhumo yipesenti ezintlanu zerhafu yakho engahlawulwanga ngenyanga, ifakwe kwiipesenti ezingama-25 bade bafumane imbuyekezo yakho. (Ngokuthelekisa, isohlwayo sokuhlawula ukuhlawula sincinci kakhulu kwiipesenti ezi-0.5 ngenyanga.)

Inye into eyahlukileyo, nangona kunjalo. I-IRS inokurhoxisa isohlwayo sakho emva kwexesha kuyo Ixesha lokuthotywa kwezohlwayo zokuqala ukuba uhlangabezana nale mithetho ilandelayo:

ukubaluleka kokomoya kwama-333

- Uneminyaka emithathu yokugcwalisa ngexesha kunye neentlawulo.

- Uzigcinile zonke iingxelo zakho zerhafu ezifunekayo.

- Uhlawule irhafu ngenxa okanye usete isicwangciso sentlawulo.

Ukuba ulungele ukukhaba isicwangciso sakho sokuhlawula ityala, Nazi iindlela ezine ezivunyiweyo ze-IRS zokuqalisa.

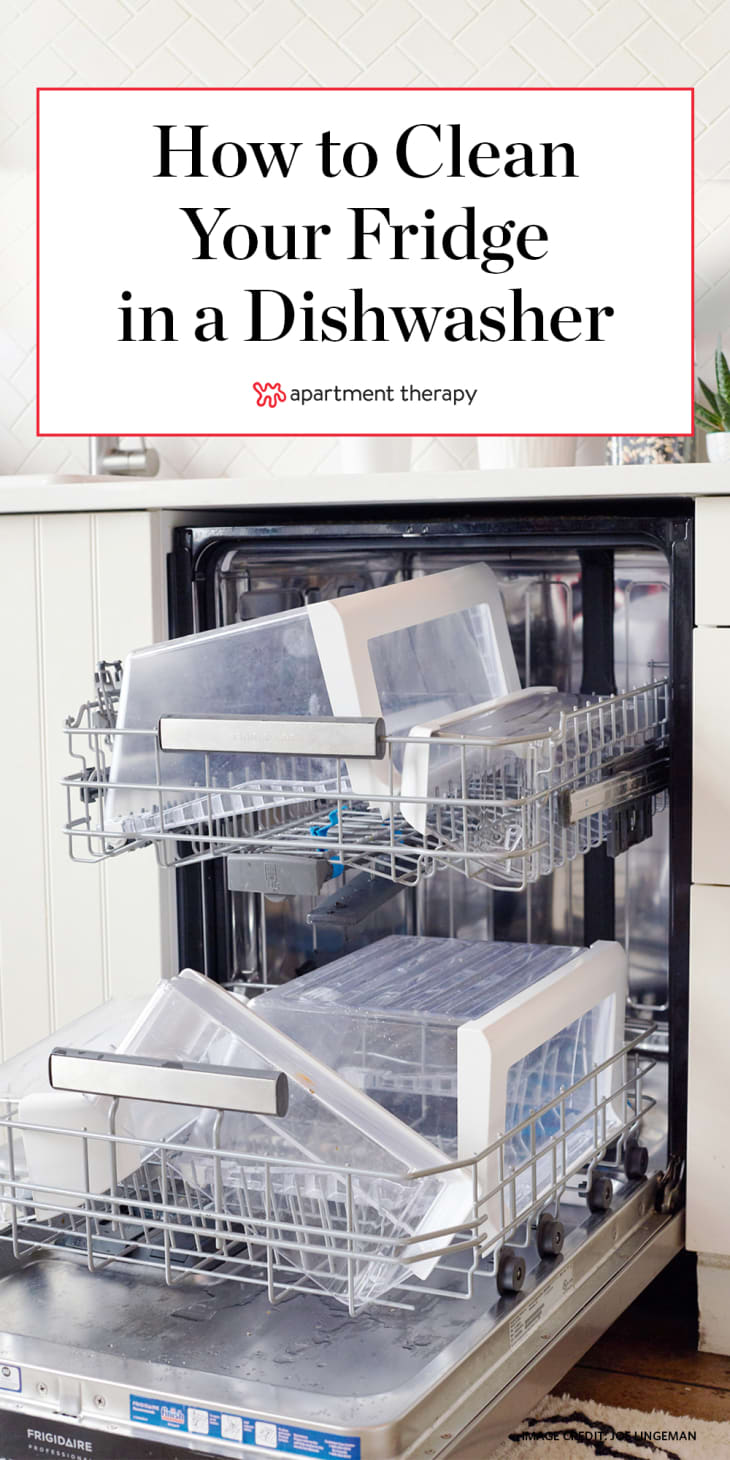

Gcina Ncamathisela Bona eminye imifanekiso

Gcina Ncamathisela Bona eminye imifanekiso Ityala: UCarina Romano

Inketho # 1: Izicwangciso zokuhlawula

Ityala lerhafu linokubothusa, ngakumbi xa kuvela ileta evela kuMalume uSam. Ngethamsanqa, i-IRS ibonelela ezimbini izicwangciso zentlawulo ukuyenza ifikeleleke ngakumbi:

- Isicwangciso seNtlawulo seXesha elifutshane: Ukuba unetyala elingaphantsi kwe- $ 100,000 kwaye unokuhlawula intlawulo kwiintsuku ezili-120, ungasayinela isicwangciso sokuhlawula sexeshana elifutshane. Akukho mrhumo wokusetha.

- Isicwangciso seNtlawulo sexesha elide: Isicwangciso sexesha elide sokuhlawula, okanye isivumelwano sezavenge, sinokukhetha ukuba unetyala le- $ 50,000 okanye ngaphantsi. Imirhumo yokuseta iyi- $ 31 yeentlawulo ezizenzekelayo okanye i- $ 149 ngaphandle kwetyala elithe ngqo, ngokuzikhethela ukuhlawula umrhumo kubantu abenza ngaphantsi kwama-250 eepesenti zenqanaba lentlupheko yomdibaniso.

Ngokubanzi, i-IRS ifuna ukuba uhlawule ityala kwiminyaka emihlanu, utshilo uCarter-Grey. Kodwa lumka, uya kuhlala unyanzelisa isohlwayo kunye nomdla de ibhalansi yakho ibe yi- $ 0.

Inketho # 2: Nikezela ukuhlawula kancinci

Ukuba ukhe waphulukana nomsebenzi, iindleko zonyango zonyango, okanye olunye ungxamiseko, i-IRS iyakuqonda kwaye inokusebenza nawe. Uthethathethwano, lubizwa ngokuba ngu nikela kwisivumelwano , unokuyihlawula ityala lakho lerhafu, kodwa ayinguye wonke umntu oya kufaneleka.

Banokulwamkela uncedo lwakho kwezi meko zilandelayo:

lithetha ntoni inani u-999

- Kukho impikiswano malunga nokuba unetyala elingakanani.

- Ingeniso yakho kunye neeasethi ziphantsi kakhulu ukuba ungalihlawula ityala lakho.

- Ukuhlawulwa kungadala ubunzima bezoqoqosho okanye kungabi nabulungisa kwaye kungalingani.

Unomdla wokuba uyafaneleka? Qala ngokufaka ulwazi lwakho kwi Mnikelo wokuNgqinisisa kwi-Pre-Qualifier . Unokufunda ngakumbi malunga nokukhetha, kunye nendlela yokufaka isicelo Apha .

Ukhetho # 3: Misa ingqokelela

Ukuba unengxaki yokugubungela iziseko, kunokwenzeka ukuba ufumane nqumama okwethutyana kwiintlawulo zakho . Ngelixa oku kunokubonelela ngendawo yokuphefumla, ngekhe umise ixesha kwizohlwayo kunye nomdla.

Ukuze ufaneleke, i-IRS iya kufuna ubungqina bobunzima bemali. Ukuba uyasebenza ngoku, gcina imali, kwaye unekhaya, i-IRS isenokungasamkeli isicelo sakho, utsho uCarter-Grey.

Inketho # 4: Hlawula ngekhadi letyala

Ukuhlawula irhafu yakho ngekhadi letyala lolunye ukhetho, kodwa kuya kufuneka usebenze amanani. Thelekisa amaxabiso enzala ngaphambi kokwenza isigqibo, utshilo uCarter-Grey. Ukuba ikhadi lakho letyala litshiphu, kunokuba sisenzo esingcono.

Ungayihoyi imali, nangona kunjalo. Ikhadi letyala Imali yokuqhubekeka Uluhlu ukusuka kwiipesenti ze-1.96 ukuya kwi-1.99 yeepesenti, ukongeza phantse i-200 yeedola kwi-10,000 yeerhafu yokuhlawula, kwaye inzala yekhadi letyala inokuba phezulu. Ngomyinge wenqanaba eliqhelekileyo elijikeleza malunga neepesenti ezili-15, ityala lakho lingakhula ngokukhawuleza kunokuba ulindele.

Okwangoku, kunokuba kufanelekile ukuba awukwazi ukuhlawula iintlawulo zenyanga ezivela kwi-IRS. Kungabiza ngaphezulu ekuhambeni kwexesha, kodwa kunokuba lula ukulawula, utshilo uCarter-Grey.

Ithetha ukuthini xa uqhubeka ubona i-111

Gcina Ncamathisela Bona eminye imifanekiso

Gcina Ncamathisela Bona eminye imifanekiso Ityala: Isandla seMinette

Kwaye ungoyiki ukucofa ingcali ngoncedo.

Iirhafu zinokuba noxinzelelo kwaye akufuneki uthandabuze ukucela uncedo xa ulufuna. UCarter-Grey uthi ingcali yerhafu, njengearhente ebhalisiweyo (i-EA), i-accountant yoluntu eqinisekisiweyo (i-CPA), okanye igqwetha lerhafu, inokuthetha ne-IRS malunga netyala lakho kwaye izame ukuxoxisana nawe.

Ukusebenza neengcali zerhafu kunokunciphisa uxinzelelo, utshilo uCarter-Grey. Kufana nokuba nomntakwenu omkhulu okanye udade omkhulu ukukukhusela.

Ukuba awukwazi ukuhlawulela ingcali yerhafu, unokulungela ukufumana ingcebiso yasimahla okanye yexabiso eliphantsi ngokusebenzisa Iiklinikhi zabahlawuli bemivuzo ephantsi (LITC) , iqela lokukhuthaza i-IRS. Kungakhathaliseki ukuba uthatha isigqibo, kubalulekile ukuthatha inyathelo. Ukuba awuyihoyi imali, kuyakubakho ingxaki, utshilo.

![Eyona peyinti imhlophe yokhuni e-UK [2022]](https://hotelleonor.sk/img/blog/76/best-white-paint-wood-uk.jpg)